A future value calculator is a helpful tool that shows you how much your money will grow over time. By using this calculator, you can see how your savings can increase with interest. It helps you understand the power of saving and investing.

With a future value calculator, you can play with different numbers. For example, if you save a little money each month, the calculator shows how much you will have in the future. This way, you can make smart choices about your money,

What is a Future Value Calculator

A future value calculator is a tool that helps you figure out how much money you will have in the future. It uses a few simple things, like how much money you start with, how much you save, and the interest rate. This calculator is very useful for anyone who wants to save money smartly.

When you use a future value calculator, you can enter your current savings and see how they can grow over time. This makes it easier to understand how money can grow when you invest or save it. Knowing this helps you make better decisions about your money.

How Does a Future Value Calculator Work

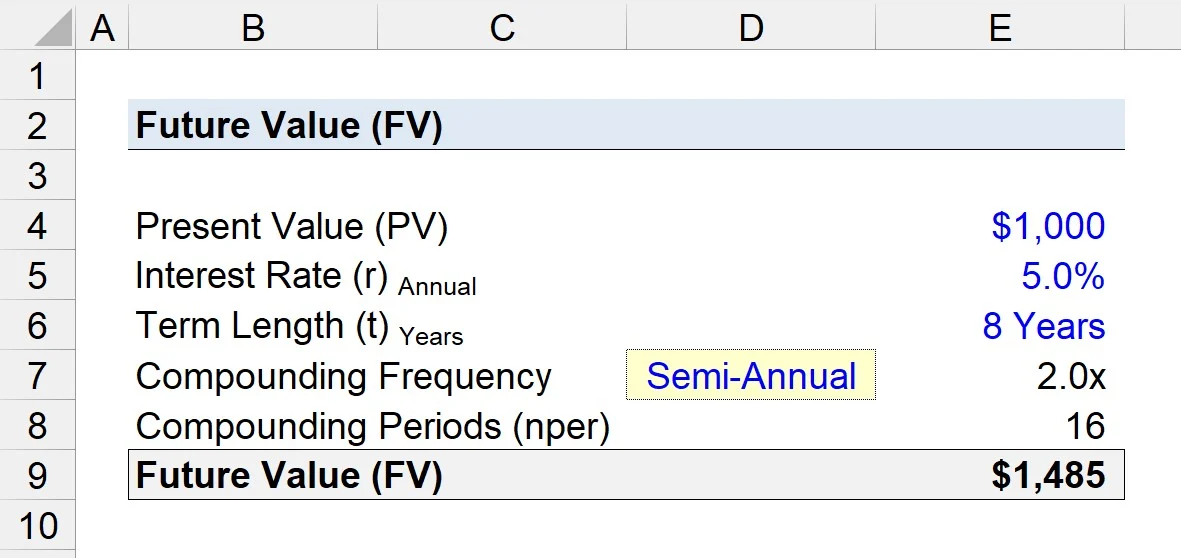

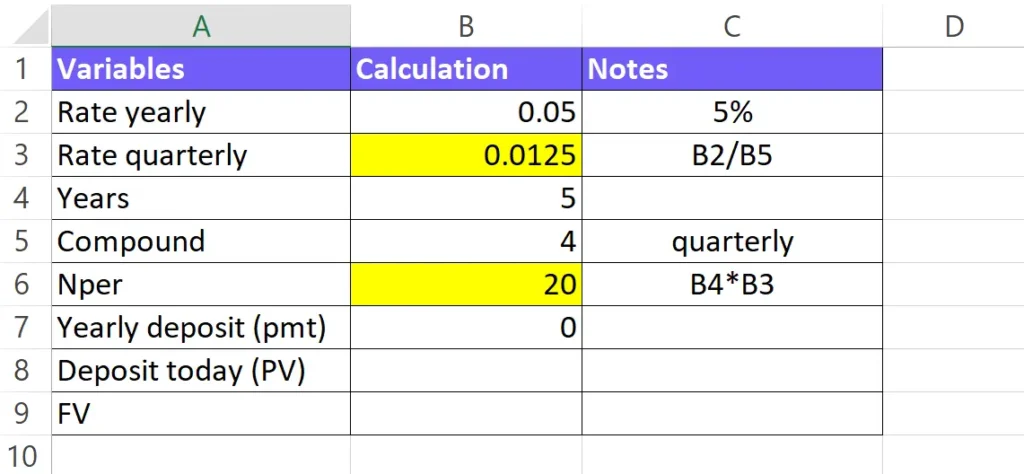

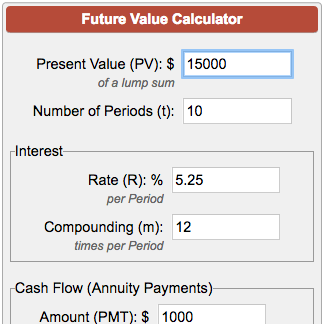

This calculator works by taking some basic information from you. First, you input the amount of money you already have. Next, you tell the calculator how much money you plan to add over time. Finally, you enter the interest rate your savings will earn.

Once you enter this information, the future value calculator does some math to show you how much money you will have in the future. It can show you different amounts for different time periods. This way, you can see how your savings can grow and plan accordingly.

Why Use a Future Value Calculator

Using a future value calculator is smart because it helps you plan your financial future. It gives you a clear picture of how your money can grow, which motivates you to save more. When you see the numbers, you can set goals for yourself.

Many people want to buy houses or go to college, and this calculator helps you understand how much money you need to save. It makes saving less confusing and more exciting. You can also compare different saving plans to see which one is better for you.

Understanding Compound Interest with the Future Value Calculator

Compound interest is a special way that your money can grow over time. It means that you earn interest on both the money you save and the interest you’ve already made. This is why using a future value calculator is so important.

When you enter your savings into the calculator, it shows how compound interest can help your money grow faster. Instead of just earning interest on your original amount, you earn interest on your interest too. This helps you reach your savings goals more quickly!

Steps to Use a Future Value Calculator

Using a future value calculator is easy and can be done in a few simple steps. First, find a calculator online or use one from a bank. Next, enter the amount of money you already have.

After that, you need to add how much money you will save regularly. Then, input the interest rate your savings will earn. Finally, choose how long you want to save. Once you click “calculate,” the tool will show you how much money you can have in the future.

Examples of Using a Future Value Calculator

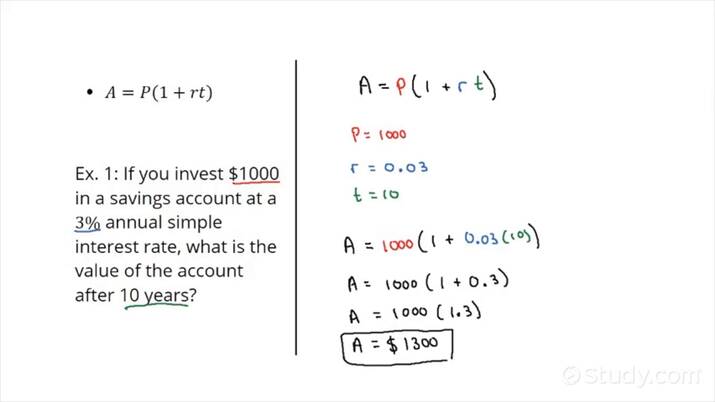

Let’s look at an example. Suppose you have $100 today, and you plan to save $10 each month. If the interest rate is 5% per year, the future value calculator can show you how much you will have in 5 years.

After 5 years, your savings will grow because of your contributions and the interest. You might be surprised at how much your savings can add up to over time! This example shows how powerful saving can be when you use the calculator.

Benefits of Planning with a Future Value Calculator

There are many benefits to planning with this calculator. First, it helps you set realistic savings goals. When you know how much you can save, you can make better decisions about spending and saving.

Also, it can motivate you to save more money. Seeing how your savings grow can inspire you to put away extra cash. Planning with a future value calculator makes managing your finances easier and more fun!

Comparing Savings: Future Value Calculator vs. Traditional Methods

When you compare using a future value calculator to traditional saving methods, you can see the differences. Traditional methods may not show you how your savings grow over time. This calculator, however, gives you clear numbers and helps you understand your progress.

Using a calculator can be much more engaging. Instead of just guessing how much money you will have, you can see the exact amounts. This makes saving feel less like a chore and more like a fun project.

Tips for Effective Saving Using a Future Value Calculator

To save effectively with this calculator, it’s essential to be consistent. Make saving a regular habit, like putting money away each month. Use the calculator to track your progress and see how your savings grow.

Also, set specific goals. Decide what you want to save for, whether it’s a new toy, a bike, or something bigger like college. Having a goal makes it easier to stay focused and motivated to save.

Frequently Asked Questions About Future Value Calculators

Many people have questions about future value calculators. One common question is, “Do I need to have a lot of money to use it?” The answer is no! You can use it with any amount, even a little bit of money.

Another question is, “How accurate are these calculators?” Most calculators are very accurate if you input the right information. Always double-check your numbers for the best results.

How a Future Value Calculator Can Help Your Goals

A future value calculator is a helpful tool for reaching your financial goals. By using it, you can see how your savings can grow and plan your finances better. Whether you want to save for a trip or a new gadget, this calculator can help you.

When you know your savings goals, you can create a plan to reach them. The calculator shows you what you need to do to achieve those goals. This makes saving exciting and purposeful!

The Importance of Starting Early: Future Value Calculator Insights

Starting to save early is very important. The sooner you begin saving, the more time your money has to grow. A future value calculator can show you just how powerful starting early can be.

By seeing the differences in savings over time, you can understand why it’s good to start young. Even small amounts can add up if you give them time. This is a valuable lesson that everyone should learn!

Conclusion

A future value calculator is a fun and useful tool for everyone. It helps you see how your money can grow over time, making saving exciting. When you use this calculator, you can set goals and make plans to reach them. Understanding how money works can help you make smart choices for your future.

Remember, starting to save early is key! The sooner you begin, the more your money can grow. With a future value calculator, you can easily track your progress and stay motivated. So, start using a future value calculator today and watch your savings dreams come true.