enterprise value is an important term in the business world. It shows how much a company is really worth. To find the enterprise value, people look at the company’s total market value. This includes all the money from its stocks and debts.

When you know the enterprise value, you can make better decisions. This number helps investors understand if a company is a good buy. In this blog post, we will learn more about enterprise value and why it matters.

What Is Enterprise Value

Enterprise value is a way to measure how much a company is truly worth. It looks at all parts of the company, not just the stock price. To understand enterprise value, think of it like a puzzle. Each piece of the puzzle tells us something about the company’s value.

When we talk about enterprise value, we need to include things like debts and cash. This helps create a complete picture of the company. For example, if a company has a lot of cash, its value might be higher. On the other hand, if it has a lot of debt, its value might be lower. This makes understanding enterprise value very important for investors.

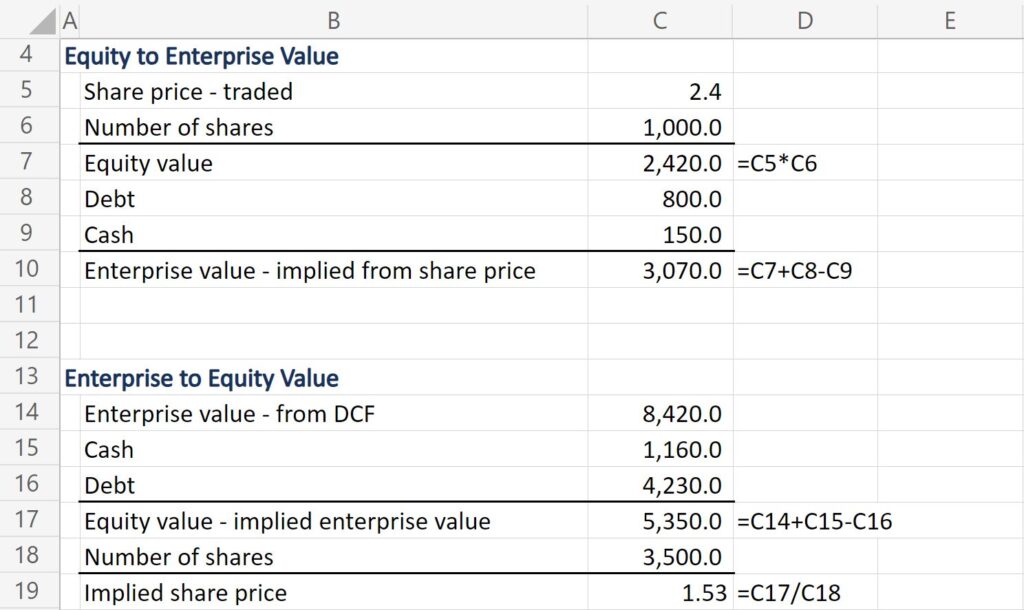

How to Calculate Enterprise Value

Calculating enterprise value is not too hard. First, we take the total number of shares and multiply it by the stock price. This gives us the market capitalization. Next, we add any debts the company has. Finally, we subtract the cash the company holds. This way, we get a clear number showing the enterprise value.

Let’s look at an example. Imagine a company has 1 million shares, and each share costs $10. This means the market capitalization is $10 million. If the company has $2 million in debt and $1 million in cash, the calculation would be $10 million + $2 million – $1 million. So, the enterprise value would be $11 million.

Why Is Enterprise Value Important

Knowing the enterprise value helps investors make smart choices. When investors want to buy a company, they look at this number. It shows whether the company is a good investment or not. A lower enterprise value can mean the company is a bargain, while a higher value might mean it is overpriced.

Moreover, comparing different companies can be easier with enterprise value. Investors can see which companies are similar and which ones are better deals. This way, they can decide where to put their money. Understanding this number is crucial for making wise financial decisions.

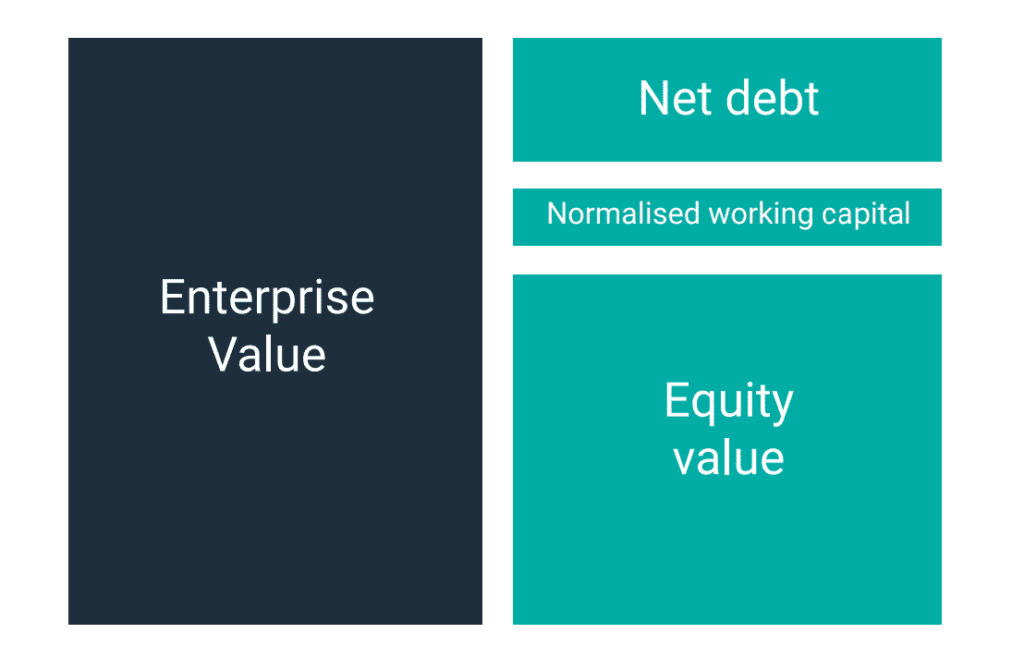

Enterprise Value vs. Market Capitalization

Enterprise value is different from market capitalization. While market capitalization looks only at the stock price, enterprise value takes everything into account. This includes debts and cash, giving a fuller picture.

For example, a company with a high stock price might look great at first. But if it has a lot of debt, the enterprise value tells a different story. Investors should not only focus on the stock price but also consider enterprise value. This ensures they get the best value for their money.

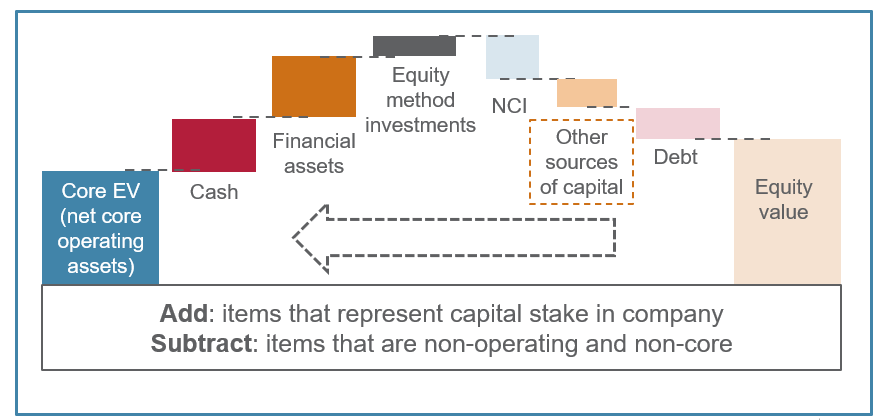

The Components of Enterprise Value

Several components make up enterprise value. The most important ones are market capitalization, debt, and cash. Market capitalization is the value of all shares. Debt is the money a company owes, and cash is the money it has in the bank.

Understanding these components is key. They show how a company manages its money. A company with less debt and more cash is usually in a stronger position. This can lead to a higher enterprise value, making it more attractive to investors.

How Enterprise Value Affects Investors

For investors, enterprise value is a powerful tool. It helps them understand the real worth of a company. When they see the enterprise value, they can make better investment choices. This number can highlight opportunities and risks.

Investors can also use enterprise value to compare companies in the same industry. If one company has a much lower enterprise value than its competitors, it might be undervalued. This is a sign for investors to take a closer look.

Real-Life Examples of Enterprise Value

Let’s look at some real-life examples of enterprise value in action. For instance, a well-known tech company might have a high market cap due to its stock price. However, if it also has a lot of debt, its enterprise value might tell a different story.

In contrast, a smaller company with less debt and cash can have a healthy enterprise value. This might attract investors looking for good deals. These examples show how enterprise value can help investors choose the right companies to invest in.

Common Mistakes in Calculating Enterprise Value

Sometimes, investors make mistakes when calculating enterprise value. One common mistake is ignoring debt. If someone looks only at market cap, they might miss important details. Debt can significantly affect the enterprise value, so it’s crucial to include it.

Another mistake is overlooking cash. If investors forget to subtract cash, the enterprise value will be higher than it should be. This can lead to wrong investment decisions. Being careful and checking all components is essential for accurate calculations.

Tips for Understanding Enterprise Value

Here are some tips for understanding enterprise value better. First, always remember to consider all components. This includes market cap, debt, and cash. Each part helps build a complete picture of the company’s worth.

Second, practice calculating enterprise value with different companies. The more you do it, the easier it becomes. Also, try comparing companies within the same industry. This will help you see how enterprise value changes among similar businesses.

The Role of Debt in Enterprise Value

Debt plays a big role in enterprise value. Companies with high debt levels can have a lower enterprise value. This is because the debt subtracts from the overall worth. On the other hand, a company with low debt might show a higher enterprise value.

Investors must consider debt when evaluating a company. It can indicate financial health and stability. Understanding how debt impacts enterprise value helps investors make informed choices.

Comparing Companies Using Enterprise Value

Comparing companies using enterprise value can be helpful. It allows investors to see which companies are performing better. By looking at the enterprise value, they can spot companies that are undervalued.

When comparing, it’s important to look at companies in the same industry. This ensures that the comparison is fair. Investors should also consider market conditions and trends. This way, they get a clearer picture of a company’s potential.

Mastering Enterprise Value

mastering enterprise value is important for anyone interested in investing. This number provides a complete view of a company’s worth. It helps investors make smart decisions and avoid common mistakes.

By understanding enterprise value, investors can compare companies and find great investment opportunities. Remember to consider all components, including debt and cash. With this knowledge, anyone can become a better investor!

Conclusion

In conclusion, understanding enterprise value is very important for investors. It helps them see the real worth of a company. By looking at this number, investors can make better choices about where to put their money. It also helps them compare different companies to find the best deals.

Overall, learning about enterprise value can be fun and exciting! It gives a clear picture of a company’s financial health. When you know how to calculate and use enterprise value, you become a smarter investor. Keep exploring and learning about enterprise value to make the best investment decisions,